how to find bull flag stocks

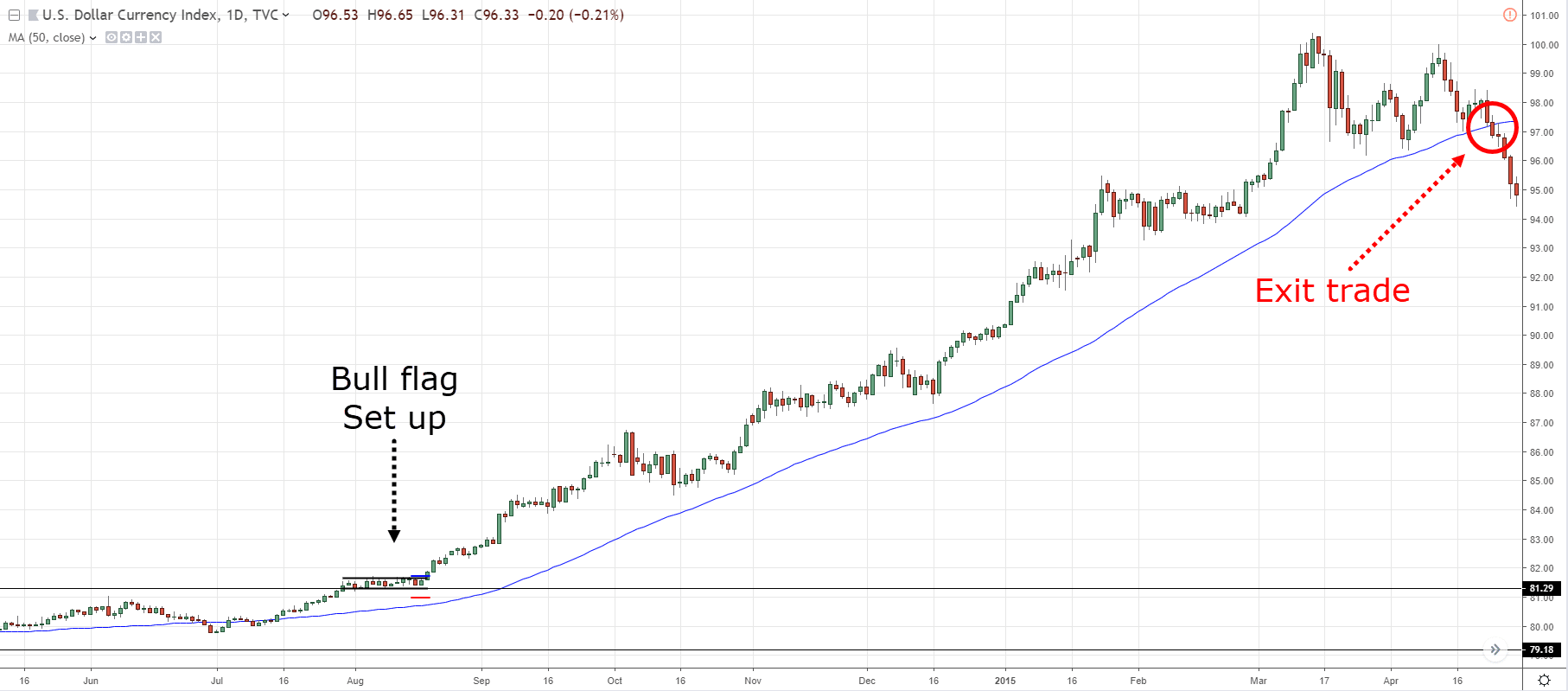

In a bull flag pattern there needs to be a 90 price rise or more within a couple months before the horizontal consolidation. Bull flag and bear flag are both continuation patterns that form when the price of a stock or asset pulls back from the predominant trend in a parallel.

How To Trade Bull Flag Pattern Six Simple Steps

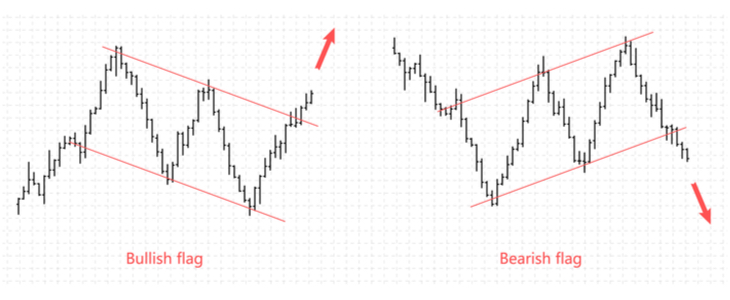

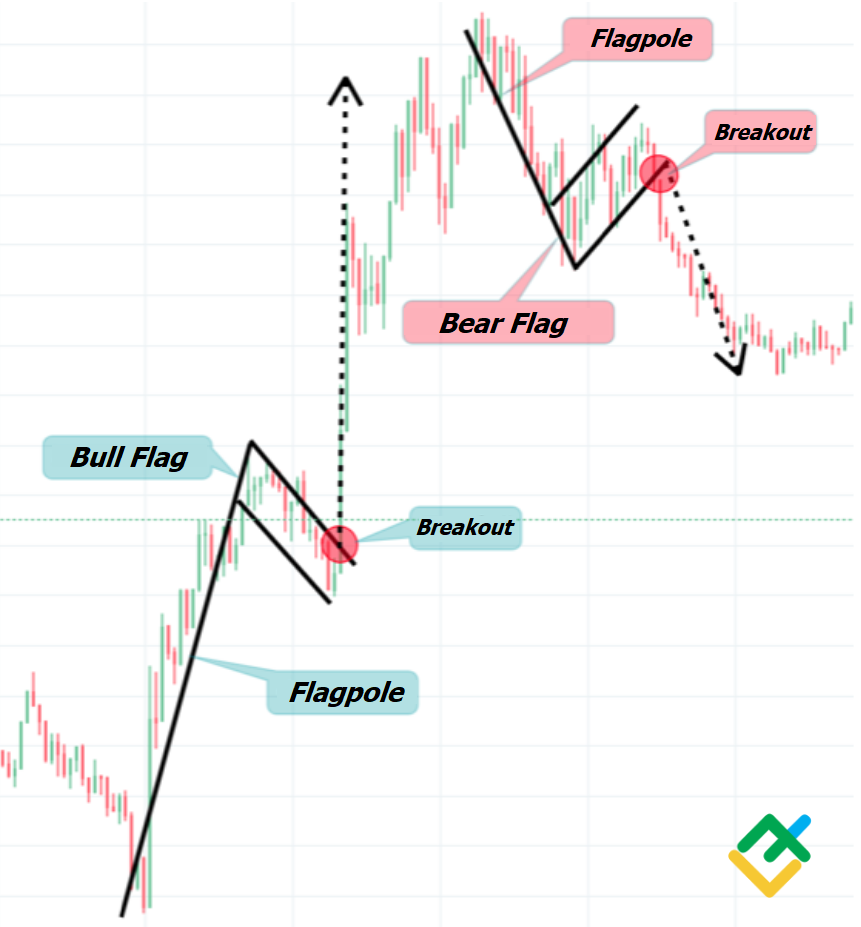

The flag pattern can be bullish or bearish.

. You can use a stock screener such as Finviz to help you find bull flags occurring in stocks. This screen finds bull flag patterns. Its what keeps the stock from rallying again.

How to trade bull flag patterns. The bull flag has the following pros and cons. The bull flag is a clear technical pattern that has three distinct components.

Watch for a bullish candlestick that forms a flag pole. This designation depends on what the flag says about where the price is headed. Look for at least 3 or more consolidation candles that hold support levels.

You dont want to jump in. Trading volume is an additional key element in identifying a bull flag. Tradingweeklyprevious week ve next week may ve - Monthly cci above 100 and.

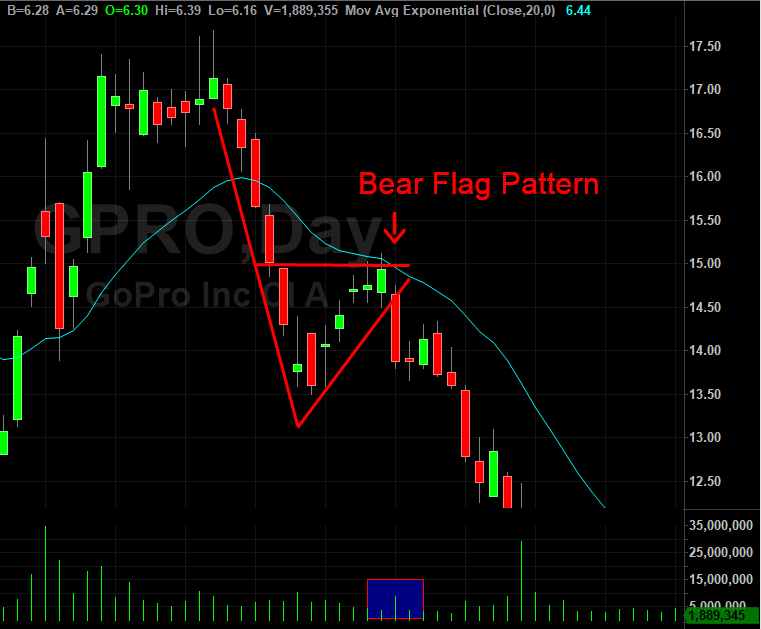

Basically despite a strong vertical rally the stock refuses to drop appreciably as bulls snap up any shares they can get. The bear flag is an upside down version of the bull flat. Hey everyone what are your thoughts on this type of video.

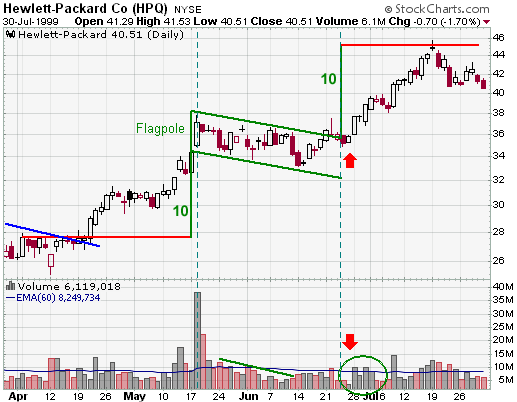

The flagpole forms on an almost vertical panic price. Traders may find it while trading any market including forex stocks indices cryptocurrencies. Stay tuned for my 3 st.

Delivery stocks - Breakout ichi super - Oversold - Sample-sobhalin-1212 - Macd daily buy. Pay Attention to the Resistance. For example the bull flag pattern is where the flag.

The pattern takes shape when the stock retraces by. The stock history shows a sharp rise which is the flag pole followed by an up and. A bull flag pattern is a bullish trend of a stock that resembles a flag on a flag pole.

It has the same structure as the bull flag but inverted. The resistance is the most important thing to watch on a bull flag pattern. Respectively they show a strong directional trend a period.

The breakout from a flag often results in a powerful move. The flag pole the flag and the break of the price channel. The Bull Flag and Volume.

Pros and Cons of Bull Flag. Downtrend vs uptrend. Today we talked about screening stocks and finding good bull flag patterns.

A bull flag is a technical continuation pattern which can be observed in stocks with strong uptrends. Anything less than that and you have a less bullish flag pattern.

What Is A Bull Flag Pattern Bullish How To Trade With It Bybit Learn

How To Trade Bullish Flag Patterns

How To Trade Bullish Flag Patterns

Bull Flag Chart Pattern Trading Strategies Warrior Trading

Flag Pattern Trading Learn The Basics Investment U

Flag Bullish Bearish Chart Pattern By Ktitrading Com Medium

:max_bytes(150000):strip_icc()/Clipboard02-b44bbb784a17494eb286aa590843d493.jpg)

Bullish Flag Formation Signaling A Move Higher

How To Use The Flag Chart Pattern For Successful Trading

How To Trade Bull Flag Pattern Six Simple Steps

Bull Flag Price Action Trading Guide

Bullish Flag Chart Patterns Education Tradingview

Bull Flag Chart Patterns The Complete Guide For Traders

How To Trade Bullish Flag Patterns

Bull Flag Pattern Trading Profit In A Bullish Market

The Bull Flag Pattern Trading Strategy

How To Identify A Bull Flag In Real Time Conditions The Daily Hodl

What Is Bull Flag Pattern And How To Use It In Trading Litefinance